Divorce can be one of the most emotionally challenging experiences you can go through, and the financial complexities often add to the stress.

When it comes to dividing assets, some are easier to split than others. The family home, likely one of your most valuable possessions, can be particularly difficult to handle.

Each option for splitting the property and the proceeds have significant financial and emotional consequences. So, it requires careful consideration to ensure the long-term financial security of you and your ex-partner, as well as the stability of any children involved.

While stabilising the financial aspects of a divorce is unlikely to remedy the emotions at play, it can be beneficial to have one less thing to worry about amid such a difficult time.

So, read on to discover four common ways to split your shared home when you divorce.

1. Sell the property and both move out

Perhaps the financially simplest option for splitting your home when you divorce is to sell the property, split the proceedings based on your respective stakes, and then use the money you both receive to buy new, separate properties.

This provides you and your ex-partner with a clean break from one another, ensuring that once the sale is complete and the proceeds are divided, you are no longer financially tied together by the property.

Of course, selling your home and both moving out requires your shared home to be of sufficient value to fund the purchase of two other properties, which may mean you both have to settle for something more modest than you’re used to.

It also means that, if you have children, they will have to move from the family home and may have to split their time between two houses.

So, while this option can be simple and offers a clean financial break, there are emotional considerations that could be more complex.

2. Arrange for one party to buy the other out

If either you or your partner wants to keep the property, you may decide for one party to buy the other out.

This can either be done with cash payments or by using other assets in the divorce settlement to offset the costs of one partner buying the other’s share in the property.

For example, if you had £100,000 equity in your home and £100,000 in pension savings, one party may decide to take the property while the other takes the savings.

The purchasing partner may need to increase their mortgage to buy out the other party, and they will need to prove to their provider that they can afford the whole mortgage alone.

You’ll also need to involve solicitor to transfer ownership of the property.

You might choose this option in order for your children to remain in the family home, or simply because one of you likes the property or has perhaps put a lot of effort into renovating it.

However, it can be financially complex as one party needs to be able to afford the mortgage on their own.

Moreover, you’ll both be responsible for the mortgage repayments until the person keeping the house has brokered a new mortgage and the ownership has been transferred – even if one of you moves out.

3. Keep the home and not change who owns it

In this scenario, either you or your ex-partner could continue to live in the property while the other moves out, perhaps until your children leave home.

Again, this is a good option if you want to ensure your children’s stability amid the upset of the divorce process.

However, it also requires one party to leave and either buy or rent a separate property and for the remaining party to maintain the mortgage repayments on their own – unless both will still contribute.

As you can see, this option can become financially complex and will keep you and your partner financially tied for as long as the ownership arrangement remains the same. Nevertheless, it does ensure your children can remain in the family home until they reach adulthood.

4. Transfer part of the value of the property from one party to the other

This option entails one party giving up a share of their ownership rights but keeping a stake in the home so that when it’s sold, they’ll receive a percentage of its value.

This can be useful if one of you wishes to remain in the home – again, perhaps for the stability of your children – while the other still wants to retain some financial interest in the property.

It allows for flexibility, as the person staying in the home avoids the immediate need to buy out the other party and the person leaving can have some money to put towards a new property. It also ensures both parties benefit from any future appreciation in the property’s value when it is eventually sold.

However, this option may become complex in the long run as it keeps you both financially tied for a potentially considerable period after your divorce. It also requires the partner remaining in the shared home to pay the mortgage on their own, or for both to contribute and the partner leaving the property to have to also pay for a separate rental property or mortgage.

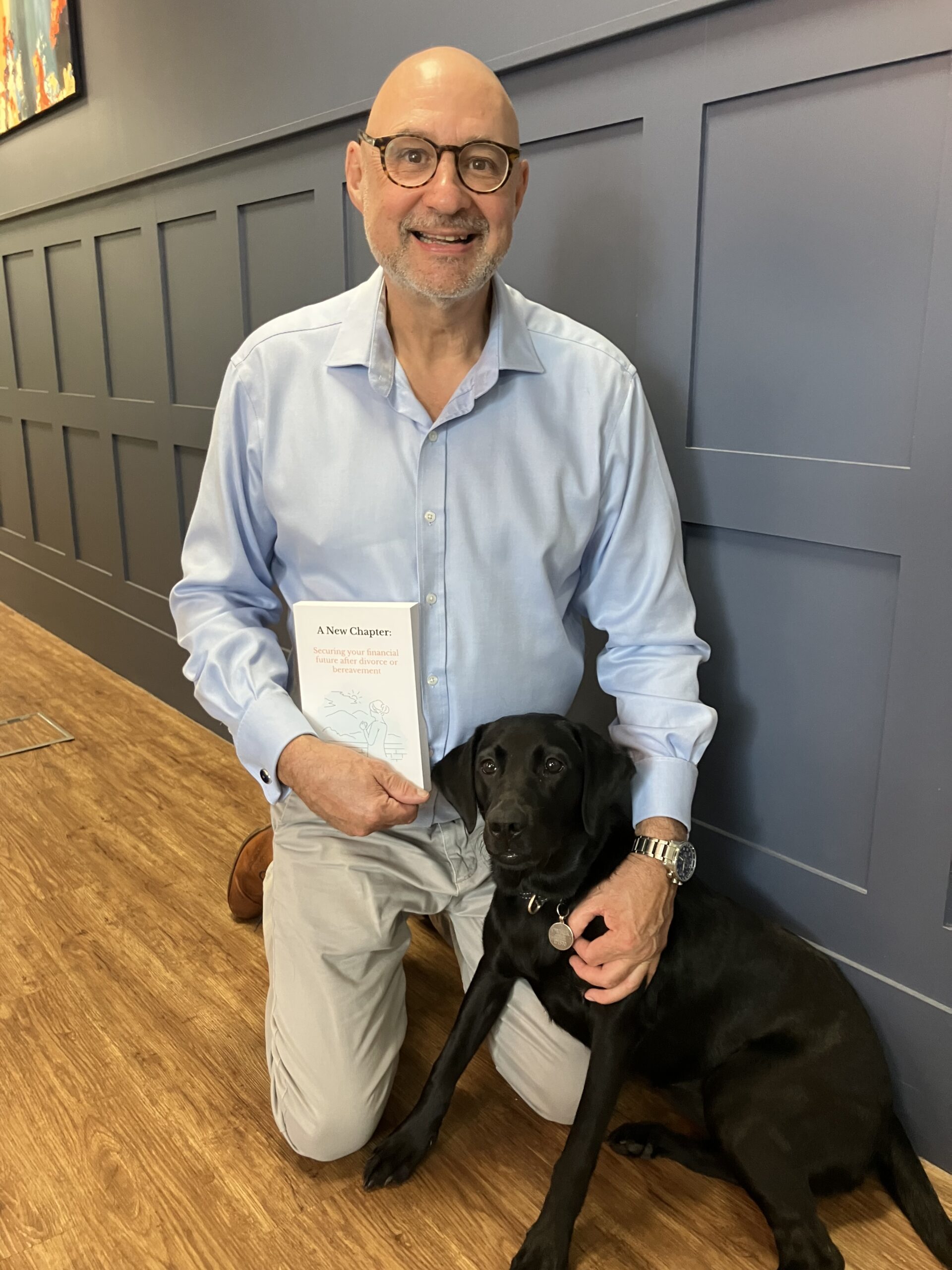

A financial planner can help you in the process of splitting your home

A financial planner can help you and your ex-partner in the process of splitting your shared home after your divorce.

They can analyse your individual financial situation and develop a comprehensive plan for dividing the property, along with other assets that may help balance the financial equation.

A financial planner can also guide you through the tax implications of your decisions and assist in creating a budget that reflects your new financial reality post-divorce.

To speak to a financial planner, get in touch.

Email hello@solusfinancial.co.uk or call us on 01245 984546.

Approved by Best Practice IFA Group Limited on 18/10/2024.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.