Solus financial planning

Fair Value StatementAbout Us

Introduction

Financial Planning starts with helping clients to identify their desired lifestyle both now and in the future. It’s about helping clients to achieve that lifestyle, without fear of running out of money on later life and then maintaining it. Financial products have a part to play, but it all starts with getting to know you and how you want to spend the rest of the time you have on this planet. Life is not a rehearsal!

This document is aimed at providing you with a brief overview of our firm and to introduce our services.

In this document, we intend to illustrate how we assess value and whether there is fair value between the total price of the service and the benefits and their quality that our clients receive.

Solus Financial Planning is based in the centre of Chelmsford and was founded by Gavin Johnson in May 2023. Gavin is a Charted Fellow of the Chartered Institute for Securities and Investments (CISI) and was awarded Fellowship of the Personal Finance Society in 2014. Gavin holds the Certified Financial Planner qualification – CFPTM and is one of less than 1,000 CFPs in the UK. The CFPTM is the only internationally recognised qualification available to advisers in the UK.

Gavin is supported by his Paraplanner, Sasha, who is a Chartered Financial Planner, and his Administrator, Jo.

Our service proposition

Our service proposition has been designed to meet the needs and objectives of our clients and to ensure fair value is received by engaging with our service.

We work with three types of clients: –

Those who have found themselves alone through bereavement or divorce

Those approaching or in retirement

Those who are still working and building their assets and planning for retirement.

Our service proposition is suitable for clients who have overall assets of £300,000 or income in excess of £100,000 per annum.

Solus Financial Planning offers a comprehensive financial planning service. This involves identifying the clients desired future lifestyle; verifying this through lifetime cash-flow modelling; designing and constructing the financial plan; identifying any financial products that are required; implementing the recommendations then reviewing and forward planning on a regular basis. We also deliver on the intangibles which experience tells us are what clients really want when they approach a financial adviser:

Peace of mind

Clarity

Understanding

Confidence

Discipline

We also think it’s important to be clear with clients what we can’t deliver:

- Predict the direction of the economy or the stock market.

- Pick hot sectors/hot funds/hot managers in advance. No one can.

- Provide high returns with low volatility (impossible)

- Sell into a temporary declining market.

- Allow client’s to do anything we wouldn’t do ourselves

- Manage client’s investment portfolio without a clear financial plan.

- Pick the correct time to invest – we believe in ‘time in’ the market and not ‘timing’ the market.

- Have an opinion on things that are outside of our control or are unimportant – the bulk of what most commentators focus on.

The Value of our Service

Solus Financial Planning is currently applying for CISI Accredited Financial Planning Firm status. We are also Appointed Representatives of Best Practice – a Member Firm.

Why did we apply for CISI Accredited Financial Planning Firm status?

Accredited Financial Planning FirmsTM demonstrate excellence in everything they do and are recognised as some of the most trusted financial planning firms in the UK. They deliver a comprehensive financial planning service, helping clients achieve their life goals. They are the leaders in their profession, demonstrating the ultimate in professionalism through the calibre of the service they provide.

The process of becoming an Accredited Firm with the CISI is the culmination of years of learning and evidence of both adherence to the CISI values, including ethics requirements, and sound business management.

Why did we choose Best Practice to work with and how does working with Benchmark benefit our clients?

Best Practice provide an institutional regulatory supervision and compliance framework service which provides us with a high level of regulatory assurance and leading-edge client management systems.

This high quality and financially sound organisation ultimately provide us with a high level of assurance and comfort around the regulatory framework of the proposition and services we deliver to you, our clients.

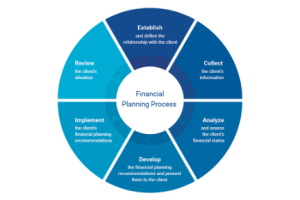

What is our financial planning process and what value will you derive from this as clients?

Solus Financial Planning’s process is a collaborative, iterative approach that considers all aspects of a client’s financial situation when formulating financial strategies and making recommendations.

The process comprises six stages:

Establish – a getting to know each other conversation to establish whether we’re a good fit and whether we can add value to what you’re doing.

Collect – a full discovery or fact find meeting – where we establish the following: –

Your goals, objectives, needs and wants

Your priorities

Your attitude to risk and capacity for loss

Analyse – Analysis of existing planning and research of potential solutions

Develop – Construct a holistic financial plan then meet to discuss the financial plan and recommendations

Implement – Put the recommended solution in place

Review – Completing the circle; updating your information, planning ahead for the next few years and the longer-term and revisiting your goals, objectives, needs and wants.

Demonstrating lifetime cash flow forecast using cash flow software is at the very heart of what we do. Once the basic plan is built it can be enhanced in a number of ways, for example: –

- Modelling What If scenarios

- Including premature death

- Market crash

- Incorporating spending goals

- Identifying shortfalls

What is our investment proposition how does is add value to our clients?

Solus Financial Planning has an investment proposition evidenced by the Firm Investment Policy Statement. The investment philosophy can be summarised in five key points: –

Capitalism works

Risk and return are related

Markets price assets fairly

Diversification is essential

Costs matter

We therefore adopt a proposition that is firmly grounded in academic research and evidence through Dimensional Fund Advisers.

Why Dimensional Fund Advisers?

The first point to make is that I have been using Dimensional Fund Advisers since 2011 and have my own money invested in their funds.

The reason I like Dimensional is their unyielding adherence to evidence. Years of academic research have shown that active management, which is more expensive, cannot reliably and consistently out-perform the markets. As David Booth, founder and Executive Chairman of Dimensional says “The number of managers that can successfully pick stocks are fewer than you’d expect by chance. So, why even play that game? You don’t need to.”

Dimensional have distilled decades of study into a set of simple philosophies; much of this research develops work undertaken by Nobel Prize winning economists who are associated with Dimensional. I especially like the fact that Dimensional’s relationships with these economists started before they won Nobel prizes, not afterwards.

Dimensional Fund Advisers was formed in 1981 and have only ever worked with financial advisers who have undertaken a lengthy approval process which ensures understanding of the underlying philosophy. Dimensional have never paid commission and they have never advertised and yet they have more than $614 billion under management as at 31st March 2023 and employ more than 1,500 people in 14 offices across the world.

Summary

Helping people achieve a “nice life” and making sure they’re “going to be ok” is at the heart of what we do. That requires a focus on the individual and what’s important to them. Building a comprehensive, personalised lifetime cash flow forecast and then using financial products to achieve those plans is what gives us a buzz.

We keep the costs of the things we can’t control – the products and money, as low as possible and place the emphasis where we’re of most benefit – You!

Considering all areas included in the assessment of value, we believe the service provided is demonstrating value overall and our service proposition along with this value statement has been approved by our network, Best Practice IFA Group Limited.