News & Blog

3 ways to use your estate plan to support vulnerable beneficiaries

A well-designed estate plan can help ensure that you have control over how your wealth is managed and distributed after you pass away. While it’s always a good idea to make plans for how your legacy will support your beneficiaries, it can be especially valuable if...

Your Spring Statement update – the key news from the chancellor’s speech

After Rachel Reeves’ impactful first Budget in autumn 2024, you might have been concerned about the announcements that would be included in her Spring Statement on 26 March 2025. Reassuringly, the major headline from this year’s springtime fiscal event is that Reeves...

A guide to women’s unique financial planning challenges and how to overcome them

We’ve made huge progress with gender equality in the past few decades, and women arguably have more social influence than ever before. For example, HR Review reports that there was an 83% increase in female CEOs and women serving on the board of companies between 2018...

A guide to your mid-life MOT

Each year, you’ll need to take your car to a trusted garage to give it an MOT test. A mechanic will assess more than 20 different areas to ensure that your car is roadworthy, so you’ll be safe when travelling. Not only does this improve safety and reduce the risk of...

A guide to passing on wealth

You’ve spent a lifetime building your wealth, so you’ll want to make sure that it’s distributed according to your wishes. Planning ahead is key to minimising the tax your loved ones will have to pay, so they get the full benefit of your hard work. It’s not always easy...

A Guide to Care Options

When suddenly faced with a loved one who needs care, making sense of what needs to be done, and who to contact, can be daunting. This guide is designed to help you navigate your way through the process, and help you confidently explore all avenues and options...

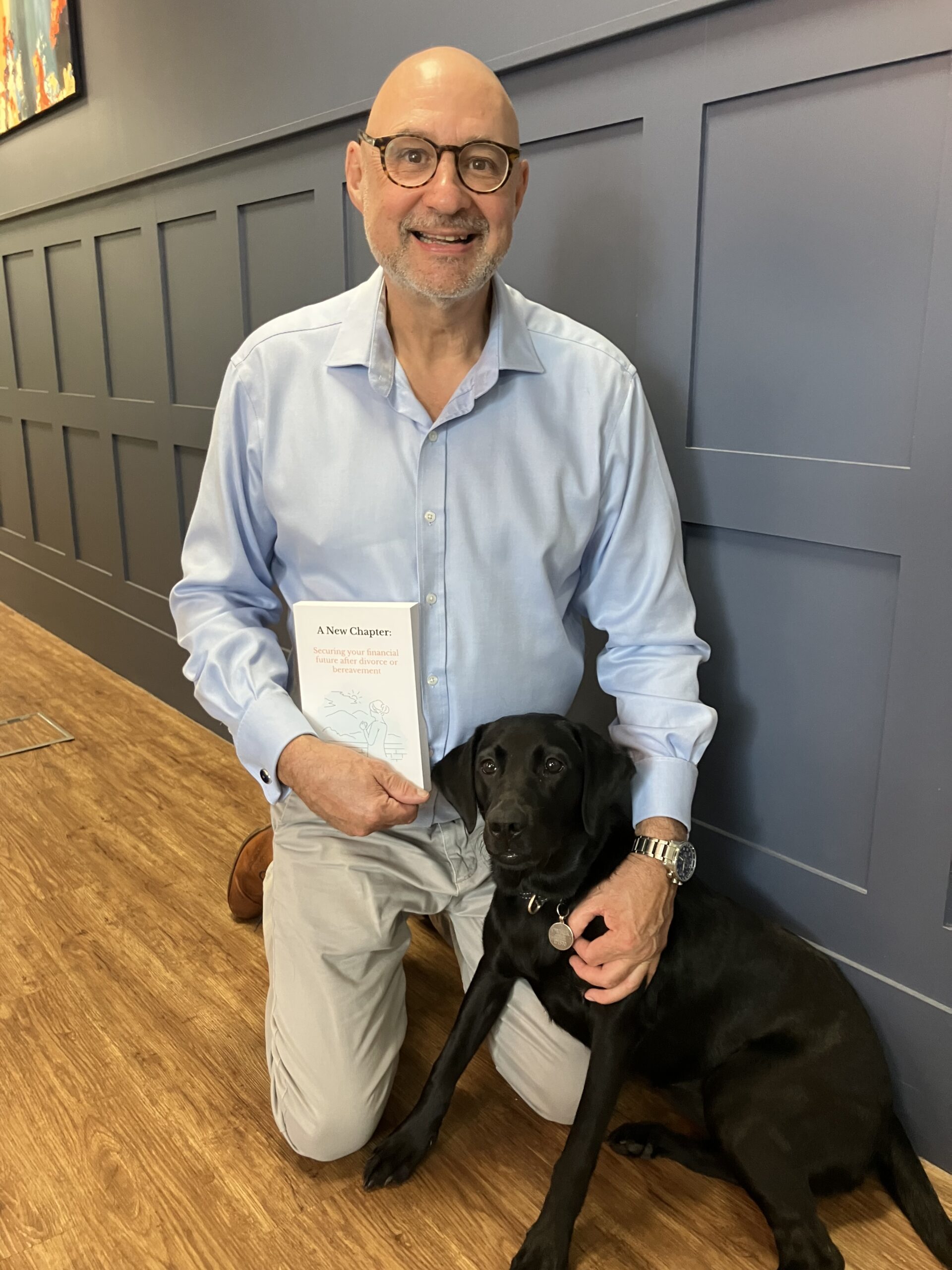

Trust

First and foremost, it’s about trust. We can get together, have a coffee and see whether we think we can work together and whether I can add value to your financial planning. If you don’t think we’re a good fit that’s fine, there’s no pressure or obligation to continue and there’s no cost involved.

Discuss

If you want to take it to the next step, we’ll talk about you. Your ambitions, your plans but also your concerns and worries. We’ll take some time to discuss what you’d like your future to look like. We believe that we can’t advise you on your money until we really understand what you want to achieve.

Plan

Once we do understand, we can start to build your future from a financial perspective. You’ll be involved all the way; after all, it’s your life and your plan. We just crunch the numbers.

We have been with Gavin for well over a decade. His friendly, patient and thorough approach to planning and explaining things to us is very reassuring. We regularly go through the current state of our financial situation with Gavin and value the on-going, personal advice.

01245 984546