News & Blog

The power of pension tax relief and how it could boost your retirement income

If you’re saving for retirement, you will want to get the most out of what you’re putting into your workplace or private pension. Fortunately, there are plenty of tax efficiencies when you save your wealth into a pension. Indeed, any investment returns generated...

Guide: 5 tips to help you manage your wealth in 2026

The start of a new year can be the perfect time to check in on your finances, set goals for the year ahead, and create a plan for how to achieve them. In fact, the Investment Association (6 January 2025) found that 43% of UK adults planned to set financial goals at...

Why retirement has a language problem and how to change the narrative

Language is powerful. The words you use to describe different scenarios can change how you perceive events, and the language used for retirement could lead to a pessimistic outlook. Writing in an article for Saga (21 October 2025), lexicographer Susie Dent explains...

5 useful tips that could help you identify financial blind spots

There are times when you may make mistakes without realising it. These mistakes could be due to blind spots, such as habits, assumptions, or risks that go unnoticed, and could affect your financial decisions. Making mistakes is a part of life. However, because hidden...

Gifting to reduce an Inheritance Tax bill? Here are 5 things to check first

In the Autumn Budget 2025, the chancellor announced that Inheritance Tax (IHT) thresholds would remain frozen for a further year, until 2031. Upcoming changes will also see unused pensions included in an estate for IHT purposes for the first time from April 2027....

7 ways financial planning could help you set realistic goals

As 2026 begins, it’s a good time to think about what you want to achieve in the coming months. A tailored financial plan can help you set realistic goals. Creating goals on your own can be challenging, especially if they bring together several different parts of your...

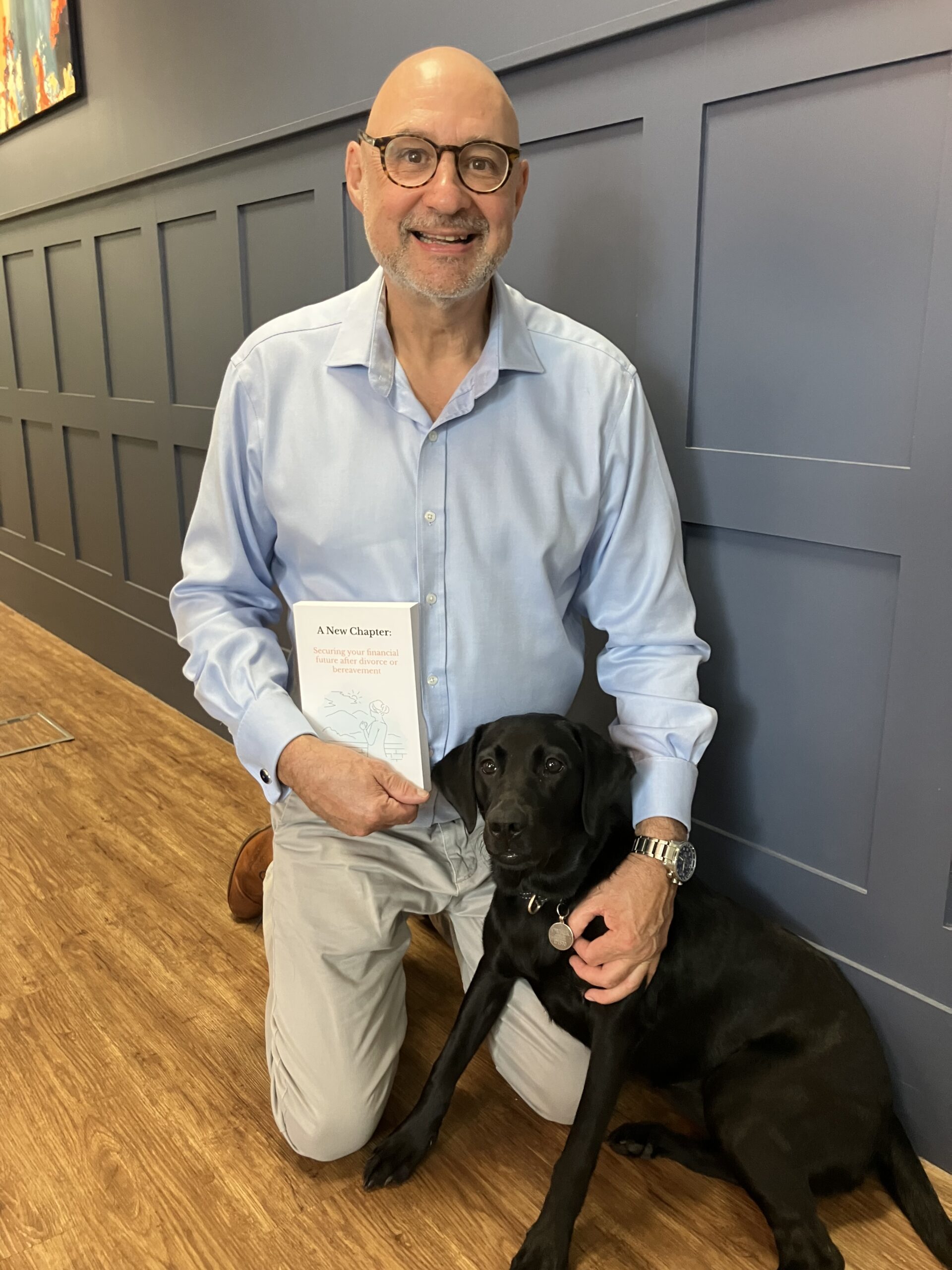

Trust

First and foremost, it’s about trust. We can get together, have a coffee and see whether we think we can work together and whether I can add value to your financial planning. If you don’t think we’re a good fit that’s fine, there’s no pressure or obligation to continue and there’s no cost involved.

Discuss

If you want to take it to the next step, we’ll talk about you. Your ambitions, your plans but also your concerns and worries. We’ll take some time to discuss what you’d like your future to look like. We believe that we can’t advise you on your money until we really understand what you want to achieve.

Plan

Once we do understand, we can start to build your future from a financial perspective. You’ll be involved all the way; after all, it’s your life and your plan. We just crunch the numbers.

We have been with Gavin for well over a decade. His friendly, patient and thorough approach to planning and explaining things to us is very reassuring. We regularly go through the current state of our financial situation with Gavin and value the on-going, personal advice.

01245 984546