News & Blog

Guide: Everything you need to know about the State Pension

Having a stable income when you retire could give you the independence to enjoy a meaningful and fulfilling life after work. Indeed, a July 2023 survey by Legal & General found that 94% of UK adults said that financial security was their most important retirement...

How to talk about finances with older family members, and why it matters

Starting conversations about money with ageing family members can feel daunting. You might worry about sounding intrusive or making someone you care about feel uncomfortable. But approaching these topics early shouldn’t be about personal gain. Rather, it should be...

It’s common to feel anxious about spending your pension. Here are 5 ways financial planning can help

*Any links in this article will direct to a third-party website and Solus Financial Planning is not responsible for the accuracy of the information contained within linked sites. Retirement is one of the most significant milestones in a person’s life. It gives you the...

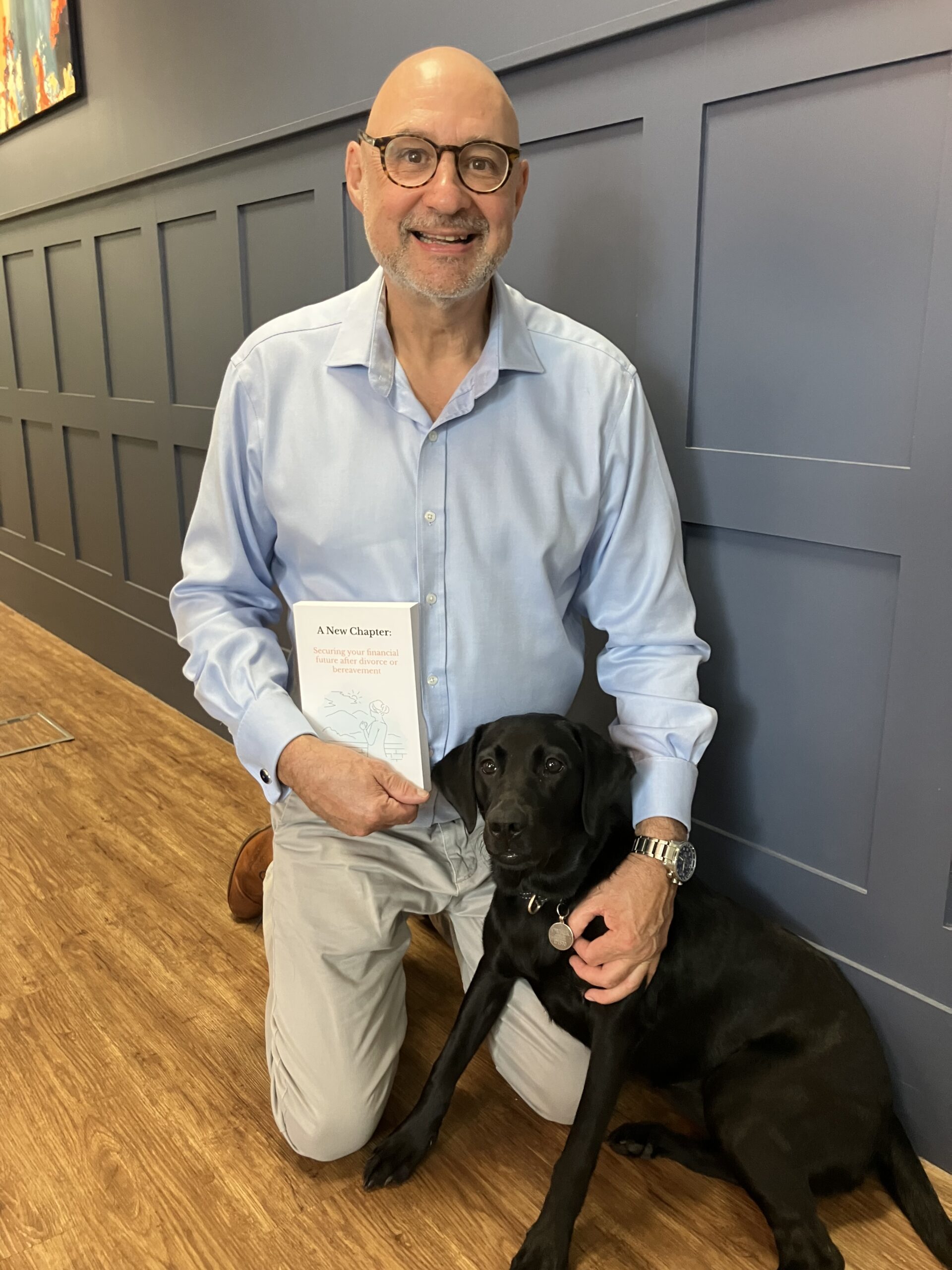

The number one question widows and divorcees ask: “Am I going to be okay?”

*Any links in this article will direct to a third-party website and Solus Financial Planning is not responsible for the accuracy of the information contained within linked sites. At Solus Financial, we specialise in supporting people dealing with complex financial and...

Guide: 12 practical reasons to write a will and name a Lasting Power of Attorney

Thinking about what might happen after you die isn’t easy. It’s hard to imagine the world simply continuing. That’s likely one reason why so many people put off writing a will for “another time” or decide to “sort it later”. But the reality is, none of us know when...

Investment market update: August 2025

While global government policy – particularly US trade tariffs – continued to influence the value of investments in August 2025, many markets experienced less volatility compared to the start of the year. Read on to discover what factors may have affected the...

Trust

First and foremost, it’s about trust. We can get together, have a coffee and see whether we think we can work together and whether I can add value to your financial planning. If you don’t think we’re a good fit that’s fine, there’s no pressure or obligation to continue and there’s no cost involved.

Discuss

If you want to take it to the next step, we’ll talk about you. Your ambitions, your plans but also your concerns and worries. We’ll take some time to discuss what you’d like your future to look like. We believe that we can’t advise you on your money until we really understand what you want to achieve.

Plan

Once we do understand, we can start to build your future from a financial perspective. You’ll be involved all the way; after all, it’s your life and your plan. We just crunch the numbers.

We have been with Gavin for well over a decade. His friendly, patient and thorough approach to planning and explaining things to us is very reassuring. We regularly go through the current state of our financial situation with Gavin and value the on-going, personal advice.

01245 984546