Fees

Our fees

Clear, fixed fees

Working with a financial adviser provides expertise and peace of mind. We build multi-decade trust-based relationships with our clients. We need to understand what really matters most to you and your family, what you are trying to achieve in life and how we can help you achieve those goals.

Put simply, we charge for the work we do, not for the amount of money being invested. We charge a fixed amount for our initial fee, which differentiates us from many financial advisers who charge a percentage based on assets.

Our fees are based upon our qualified and professional expertise, the time taken to analyse your circumstances and devise an appropriate plan, and the completion of a report that explains our

recommendations.

Our fees

Initial fee

Whatever financial decisions you must make, the first step towards making the right decisions is to establish a clear understanding of your financial needs. People seek financial advice for many different reasons, so we must understand exactly who you are and what you want to achieve before building your plan.

Our initial fee covers research and analysis, preparing your financial plan and implementing our recommendations, and we charge one fixed fee for this entire service.

This includes:

- Analysing your current position

- Researching potential solutions for your needs

- Consulting with other professional advisers or financial service providers if necessary

- Preparing a full financial planning report

- Implementing our recommendations

- Completing the relevant forms and ensuring your applications are processed by the relevant investment firms and providers.

We will estimate the total cost for you in advance of commencing work if you wish. For our initial services, we charge for the type of work conducted based on the following:

Financial planning: £320 per hour

Paraplanning or technical work: £160 per hour

Administration: £110 per hour

You can see two examples below:

Example 1

For a straightforward investment recommendation, such as a couple contributing their annual allowance into a stocks and shares ISA (£40,000) and transferring two ISAs and two pensions with a total value of £200,000, the costs may typically be as follows:

| Appropriate person | Time required | Hourly rate | Cost |

| Financial planner | 8 hours | £320 | £2,560 |

| Paraplanner | 10.5 hours | £160 | £1,680 |

| Administrator | 9 hours | £110 | £990 |

Total cost: £5,230

Example 2

For a more complex review and recommendations, encompassing several existing pensions and investments totalling approximately £500,000, the costs may typically be as follows:

| Appropriate person | Time required | Hourly rate | Cost |

| Financial planner | 10 hours | £320 | £3,200 |

| Paraplanner | 16 hours | £160 | £2,560 |

| Administrator | 14 hours | £110 | £1,540 |

Total cost: £7,300

Our fees

Ongoing fee

Your financial arrangements can change over time, including your goals and risk profile, and our ongoing review service helps to ensure your financial plans evolve to reflect such changes.

We can provide ongoing review services designed to maintain and monitor your portfolio and to ensure your financial plans remain on track to achieve your goals.

We charge 1% per year, based upon the value of your portfolio; this is capped at a maximum fee of £10,000 per client.

Example 1

You have a portfolio value of £200,000.

We will charge an ongoing fee of £2,000 per year.

Example 2

You have a portfolio value of £500,000.

We will charge an ongoing fee of £5,000 per year.

As we act on your behalf as an intermediary and intend to implement financial solutions, our fees are currently exempt from VAT, which means we do not usually have to make an additional charge of 20%.

Our latest client survey results are in

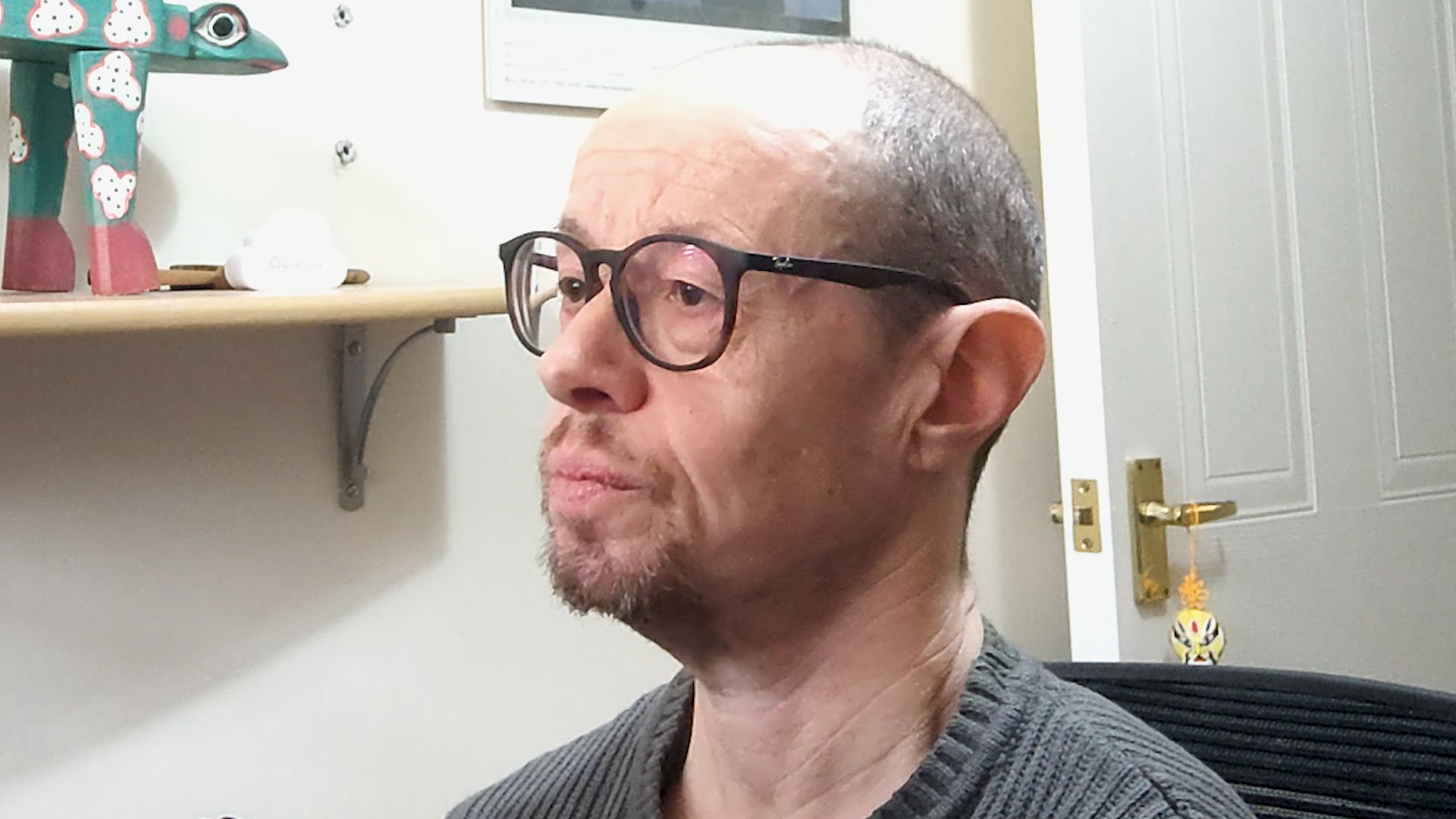

Gavin is VouchedFor Top Rated

We’re proud to say we are included in the VouchedFor Top Rated Guide for 2025, distributed by the Times. This makes it the third year in a row that Gavin has been included in the guide.

The purpose of this guide is to help identify the best advisers throughout the UK based on client feedback. Gavin’s Top Rated Adviser status on VouchedFor is evidence of the high regard he’s held in by clients just like you.

To learn more, please visit our blog post all about our inclusion by clicking here.