There’s never a better time to contribute to your pension than now.

However, when retirement is decades away it can sometimes be hard to see the value of contributing to your pension. Indeed, Scottish Widows found that 2 in 5 people in the UK did not start contributing to their pension until the age of 35.

Due to the effect of compounding – more about this in a moment – contributing more to your pension from an early age means you could build up a larger pot in the future. This is because interest is added to your pension year on year, compounding over time.

Keep reading to see the impact that saving for retirement from an early age can make to your standard of life after you finish working.

The benefits of saving early in numbers

Compounding is a powerful force that can see your savings increase in value over time.

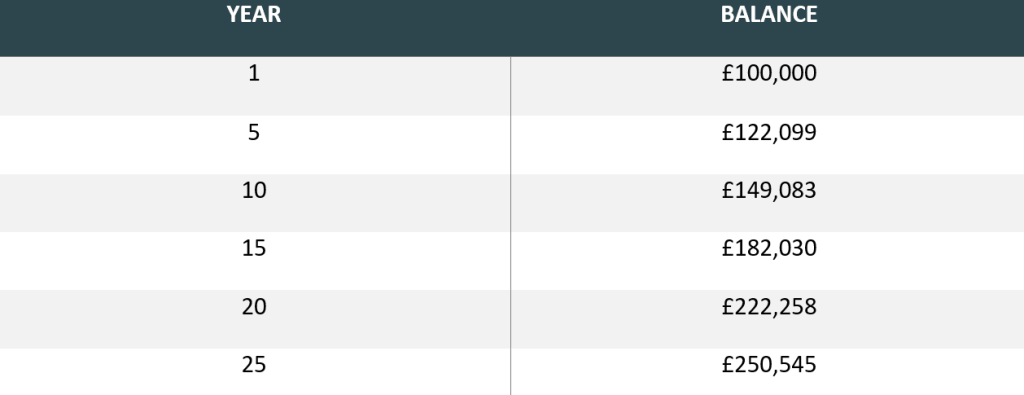

To illustrate this point, below you can see how an initial savings pot of £100,000 grows over time, assuming an annual growth rate of 4%. In this example no money is being deposited into the savings pot over time, and all increases in value are as a result of compounding.

Source: Figures in table computed using The Calculator Site’s compound interest calculator

Though the above table does not take inflation into account, the above figures do demonstrate how powerful compounding can be.

Each year a 4% return is being added onto the value that is already in the investment pot – this includes the initial £100,000 balance, and all 4% returns from previous years. Because of this, each year, with a constant return of 4%, the pot will increase by a larger cash sum than the previous year.

For example, if you invested £100,000 and achieved a growth rate of 4% you’d have £104,000 after year one. If you then left this full amount invested and achieved a rate of 4% in year two, you’d have £108,160 at the end of this year as you’ve also achieved returns of 4% on your first year of growth.

This shows how beneficial it can be to start saving for your retirement as early as possible.

According to Standard Life, an individual who starts saving for their retirement at 47 could expect to have a retirement fund of £217,000 at age 68. That’s compared to £392,000 if they started saving aged 32, as the table below shows.

Source: Standard Life (*if beginning working with a salary of £25,000 per year and paying 5% employer, 3% employee monthly contributions into a workplace pension and assuming 5.0% investment growth and 3.5% salary growth per year. Figures are not reduced to take effect of inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.)

If you start contributing to your pension earlier in life you benefit from years of compound returns. You will likely have more money in your pension when you retire than someone who has contributed the same amount as you but started doing so later in life.

How to increase your pension pot for your retirement

To maximise the size of your pension pot and achieve a level of income in retirement that can support your desired standard of living, there are a few things you can start doing now.

As previously mentioned, beginning to contribute to your pension as early as possible is one way to boost your retirement fund.

You could also consider increasing the percentage of your income you contribute to your pension.

Many employers will match your contributions so, if you increase your contribution by 1%, your employer may also pay in an additional 1%.

Some employers even offer double matching where, for example, a 5% contribution from you will trigger a 10% contribution from your employer. For a small monthly reduction in take home pay you could see a large increase in your pension upon retirement.

It’s also important to make sure you claim all the pension tax relief you are entitled to.

When you contribute to your pension, you’ll benefit from 20% tax relief on your contributions. If you’re a higher-rate or additional-rate taxpayer, this increases to 40% or 45% respectively.

You can usually contribute up to £60,000 (or 100% of earnings if lower) to your pension (2023/24 tax year) without incurring a tax charge. If you are a higher earner or you have already started flexibly accessing your pension, this amount may be lower.

Despite this tax incentive, because tax relief isn’t always automatically applied for higher-rate and additional-rate taxpayers, Standard Life report that £1.3 billion of pension tax relief has gone unclaimed over a five-year period. Make sure you know what pension tax relief you are entitled to and that you are claiming it.

Finally, if you ever receive bonuses or other irregular income like gifts, consider using them to top up your pension. One-off payments can provide a useful boost to your fund, especially when tax relief is added.

Get in touch

To discover how you can maximise your retirement fund please email hello@solusfinancial.co.uk or call us on 01245 984546.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.