News & Blog

Why tuning out political speculation may help you stick to your financial plan

In a historic victory, the Labour Party won a majority in the 4 July 2024 general election. After 14 years of Conservative government, you might be wondering what the change means for you and your financial plan. Since Keir Starmer took office, a day has barely passed...

Inheritance Tax: The basics you need to know about the “death tax”

Often dubbed “death tax” or “Britain’s most-hated tax” in the media, Inheritance Tax (IHT) may seem complex, and you might be unsure if it’s something you should consider as part of your estate plan. Over the next few months, you can read about the essentials you need...

Guide: How an Olympic mindset could help you manage your finances effectively

What makes an Olympian? Natural talent or the hours put into training might be the first things that come to mind. However, their approach and mindset play an important role in their achievements too. An athlete’s mentality will have a huge effect on how they pursue...

The value of financial planning: How it could help you achieve your aspirations

Often one of the biggest benefits of a bespoke financial plan is that it allows you to devise a blueprint to follow, with your goals placed at the centre. It’s a strategy that could help you focus on what you want to achieve in life and make working with a...

Discover 4 financial considerations that are commonly overlooked in divorce

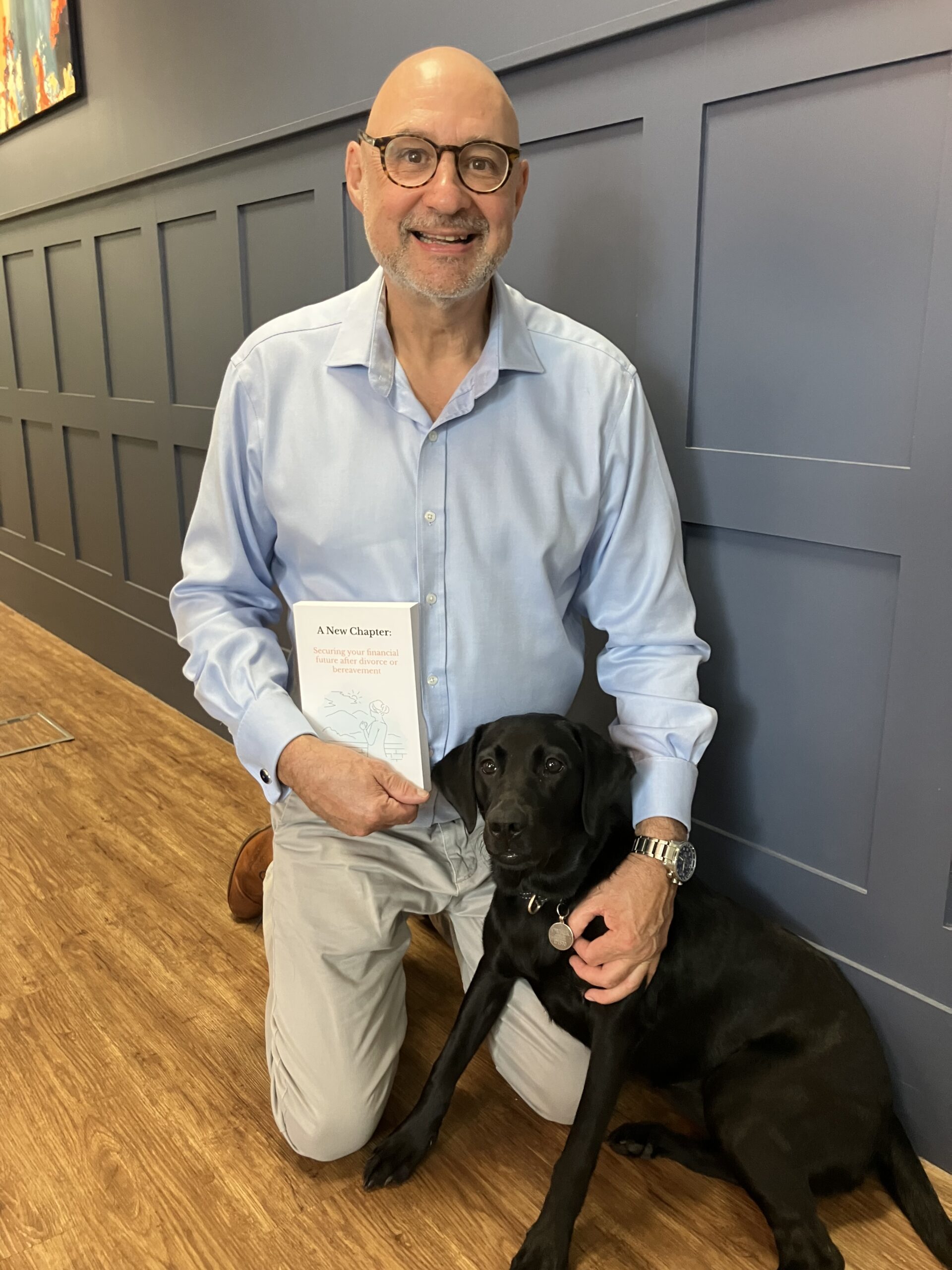

A divorce or separation is a time of transition. There are lots of things to think about, practical arrangements to sort, and difficult conversations to be had, so it’s no surprise that people sometimes overlook important financial considerations. Sadly, this can lead...

How financial planning could help if you’re unmarried and separating from your partner

Choosing to live with a long-term partner without getting married is an increasingly popular option in the UK. The Office for National Statistics (ONS) reports that, between 2011 and 2021, the proportion of couples living together who are unmarried rose from 20.6% to...

Trust

First and foremost, it’s about trust. We can get together, have a coffee and see whether we think we can work together and whether I can add value to your financial planning. If you don’t think we’re a good fit that’s fine, there’s no pressure or obligation to continue and there’s no cost involved.

Discuss

If you want to take it to the next step, we’ll talk about you. Your ambitions, your plans but also your concerns and worries. We’ll take some time to discuss what you’d like your future to look like. We believe that we can’t advise you on your money until we really understand what you want to achieve.

Plan

Once we do understand, we can start to build your future from a financial perspective. You’ll be involved all the way; after all, it’s your life and your plan. We just crunch the numbers.

We have been with Gavin for well over a decade. His friendly, patient and thorough approach to planning and explaining things to us is very reassuring. We regularly go through the current state of our financial situation with Gavin and value the on-going, personal advice.

01245 984546