News & Blog

The decumulation dilemmas you might need to overcome when you retire

One of the retirement challenges many people face is how to handle wealth decumulation. During your working life, you’re typically working to increase your wealth, and this usually shifts as you enter retirement. So, if you’re retired or are nearing the milestone,...

The power of visualising your wealth: From cloth to cashflow modelling

Understanding where your wealth is coming from and how you’re using it could help you make more informed decisions. However, as so many assets are intangible, having a clear picture of your wealth can be difficult. Finding ways to visualise all your assets is often...

Think cash is king? It might be time to review your mantra

Cash can be comforting. It’s familiar, it’s accessible, and it’s tangible. But while cash savings can be part of a well-balanced financial plan, they’re not always the best-performing asset. Data shows that many UK adults are reluctant to depart from cash. In an...

How to remain calm amid Autumn Budget speculation

The importance of remaining calm is often something that’s talked about when discussing investment market volatility. But there are other factors outside of your control that might lead to emotional decision-making, including uncertainty about the upcoming Autumn...

Planning for care: Making later-life support part of your financial plan

While many people don’t rely on care later in life, planning for the potential cost of it could help you feel confident about the future and mean you have more options should you need support. According to a December 2021 report from The Health Foundation, people are...

Unsure how to access your pension at retirement? Here’s what you need to know

It’s been a decade since Pension Freedoms legislation gave retirees more choice. Yet rather than relishing the freedom the changes have provided, research suggests workers are approaching retirement unsure about the decisions they need to make. Data published by...

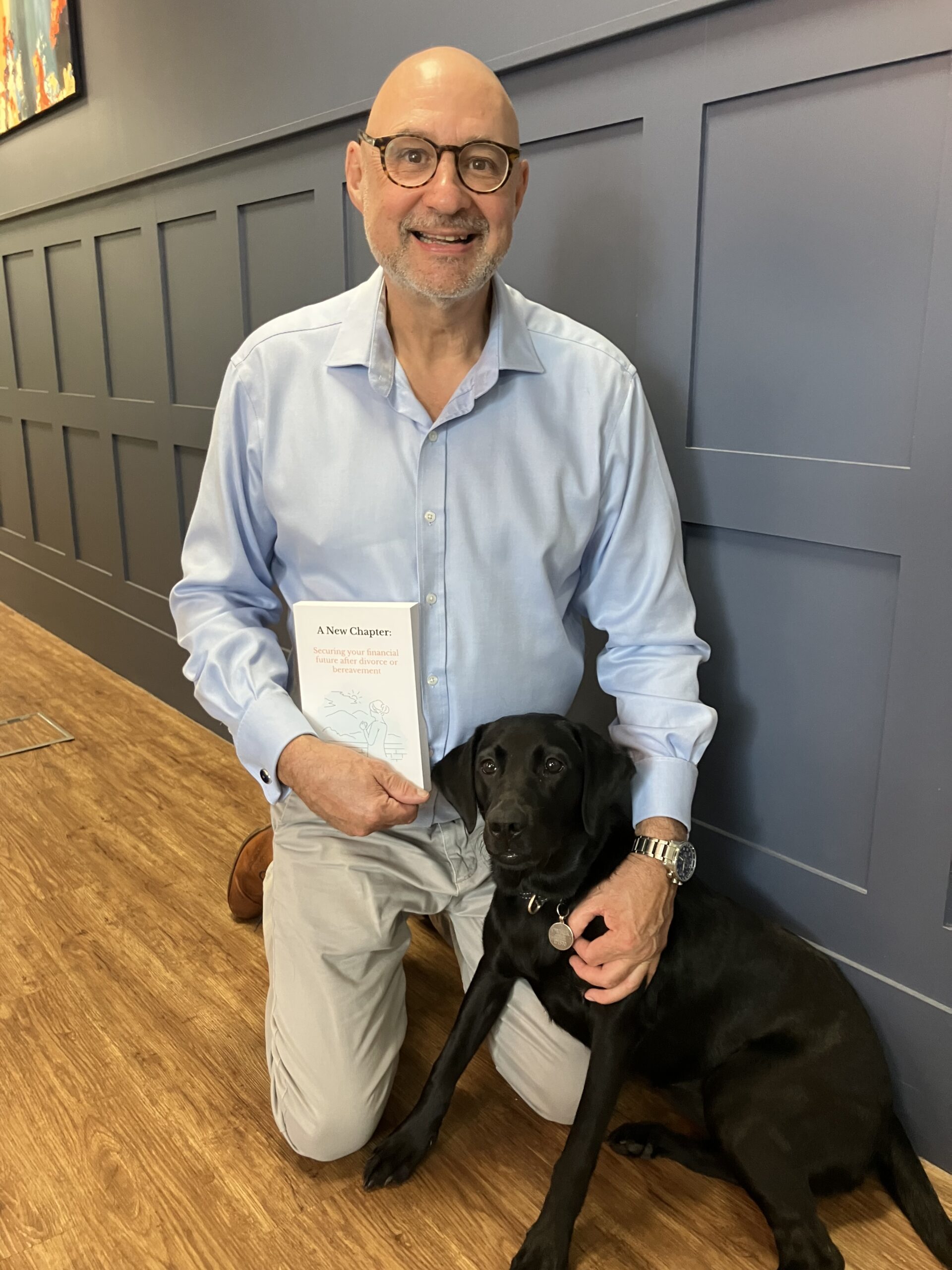

Trust

First and foremost, it’s about trust. We can get together, have a coffee and see whether we think we can work together and whether I can add value to your financial planning. If you don’t think we’re a good fit that’s fine, there’s no pressure or obligation to continue and there’s no cost involved.

Discuss

If you want to take it to the next step, we’ll talk about you. Your ambitions, your plans but also your concerns and worries. We’ll take some time to discuss what you’d like your future to look like. We believe that we can’t advise you on your money until we really understand what you want to achieve.

Plan

Once we do understand, we can start to build your future from a financial perspective. You’ll be involved all the way; after all, it’s your life and your plan. We just crunch the numbers.

We have been with Gavin for well over a decade. His friendly, patient and thorough approach to planning and explaining things to us is very reassuring. We regularly go through the current state of our financial situation with Gavin and value the on-going, personal advice.

01245 984546